Embarking on the journey of financial wellness begins with understanding how to create a budget that truly works. This guide, focusing on “How to Create a Budget That Actually Works with a 30-Day Trial Challenge,” is designed to demystify the budgeting process, providing a clear roadmap for achieving your financial goals. We’ll move beyond generic advice and dive into practical strategies, from understanding the core principles of budgeting to implementing actionable steps for long-term financial success.

This isn’t just about numbers; it’s about gaining control over your financial life. You’ll learn how to track your income and expenses effectively, set realistic financial goals, and choose the budgeting methods that best suit your needs. The 30-Day Trial Challenge will be your hands-on experience, helping you put these strategies into practice and build lasting financial habits. Get ready to transform your relationship with money and pave the way for a more secure future.

Understanding the Basics of Budgeting

Creating a budget might seem daunting, but it’s a foundational skill for financial well-being. It’s about taking control of your money and making informed decisions about how you spend it. This section will break down the core principles of budgeting, define what a budget is, and explain why it’s so beneficial. We’ll also look at common mistakes to avoid.

Core Principles of Effective Budgeting

Effective budgeting relies on several key principles. Understanding and applying these principles will significantly increase your chances of success. These principles are essential for financial health.

- Track Your Income and Expenses: The first step is to know where your money comes from and where it goes. This involves meticulously recording all income sources (salary, investments, etc.) and every expense, no matter how small. Using budgeting apps, spreadsheets, or even a notebook can help.

- Set Realistic Goals: Your budget should align with your financial aspirations. Define short-term (e.g., saving for a vacation) and long-term (e.g., retirement) goals. These goals provide motivation and direction. Make sure they are specific, measurable, achievable, relevant, and time-bound (SMART).

- Categorize Your Spending: Grouping expenses into categories (housing, food, transportation, entertainment, etc.) makes it easier to identify spending patterns and areas where you can cut back.

- Prioritize Needs vs. Wants: Distinguish between essential expenses (needs like rent, food, utilities) and discretionary spending (wants like entertainment, dining out). Allocate funds to needs first and then allocate the remaining funds to wants.

- Regularly Review and Adjust: Budgeting isn’t a set-it-and-forget-it process. Review your budget at least monthly, or more frequently if your financial situation changes. Make adjustments as needed based on your spending habits and financial goals.

- Automate Where Possible: Automate bill payments and savings contributions to ensure consistency and avoid late fees or missed opportunities.

Definition and Purpose of a Budget

A budget is a financial plan that Artikels your expected income and expenses over a specific period, typically a month. Its primary purpose is to help you manage your money effectively and achieve your financial goals.

A budget is essentially a roadmap for your money, guiding you towards your financial destinations.

It acts as a spending plan, helping you to control your spending, save money, and avoid debt. By creating a budget, you gain insights into your financial habits and make informed decisions about where your money goes.

Benefits of Creating a Personal Budget

The advantages of budgeting are numerous and extend beyond simply tracking your money.

- Financial Control: A budget puts you in charge of your finances. You know where your money is going and can make conscious choices about how to spend it.

- Debt Reduction: By tracking expenses and identifying areas to cut back, a budget can help you reduce debt and avoid accumulating more.

- Increased Savings: A budget allows you to allocate funds specifically for savings, whether for emergencies, retirement, or other goals.

- Reduced Financial Stress: Knowing you have a plan for your money can significantly reduce stress and anxiety related to finances.

- Achieving Financial Goals: A budget provides a framework for reaching your financial goals, such as buying a home, paying off student loans, or investing for the future.

- Improved Decision-Making: With a clear understanding of your finances, you can make better decisions about purchases, investments, and other financial matters.

Common Pitfalls in Budgeting

Many people struggle with budgeting. Avoiding these common pitfalls can significantly increase your chances of success.

- Lack of Planning: Not taking the time to create a detailed budget is a major mistake. A vague idea of your finances isn’t enough.

- Ignoring Expenses: Failing to account for all expenses, including irregular or infrequent ones (e.g., car maintenance, holiday gifts), leads to inaccurate budgeting.

- Unrealistic Expectations: Setting overly ambitious goals or unrealistic spending limits can lead to frustration and failure.

- Not Tracking Spending: Failing to monitor your spending against your budget undermines the entire process.

- Lack of Flexibility: Budgets need to be adaptable. Life happens, and unexpected expenses arise. A rigid budget is likely to fail.

- Giving Up Too Soon: Budgeting takes time and effort. Don’t get discouraged if you don’t see immediate results. Stick with it and make adjustments as needed.

Setting Financial Goals

Before diving into the nitty-gritty of budgeting, it’s crucial to define your financial goals. This step acts as the compass, guiding your financial journey and providing the motivation needed to stick to your budget. Without clear goals, budgeting can feel aimless and difficult to maintain. Understanding what you’re working towards makes the process much more meaningful and sustainable.

Importance of Defining Financial Goals

Establishing financial goals is the foundation upon which a successful budget is built. These goals provide a sense of purpose and direction, making it easier to make informed financial decisions. They also serve as benchmarks, allowing you to track your progress and celebrate your achievements.

Distinction Between Short-Term and Long-Term Financial Goals

Financial goals can be broadly categorized into short-term and long-term objectives, each with its own timeframe and implications.

- Short-Term Goals: These are goals that you aim to achieve within a relatively short period, typically within a year or less. They are often smaller in scale and can provide a sense of immediate satisfaction, reinforcing positive financial behaviors. Examples include building an emergency fund, paying off a small debt, or saving for a vacation.

- Long-Term Goals: These goals require a longer time horizon, often spanning several years or even decades. They usually involve larger sums of money and require consistent effort and planning. Examples include saving for retirement, buying a house, or funding a child’s education.

Examples of SMART Financial Goals

SMART goals are specific, measurable, achievable, relevant, and time-bound. Using this framework ensures your financial goals are well-defined and increases your chances of success.

- Specific: Clearly define what you want to achieve. Instead of “Save money,” aim for “Save $5,000 for a down payment on a car.”

- Measurable: Establish how you will track your progress. For instance, “Track my spending weekly using a budgeting app.”

- Achievable: Set realistic goals based on your income and current financial situation. Don’t aim to save an unrealistic amount.

- Relevant: Ensure your goals align with your values and priorities. Is the goal important to you?

- Time-Bound: Set a deadline to create a sense of urgency. For example, “Save $5,000 in 12 months.”

SMART Goal Formula: Specific + Measurable + Achievable + Relevant + Time-Bound = Financial Success

Financial Goals and Potential Timelines

The following table provides examples of financial goals and their typical timelines. Remember that these are just examples, and your specific goals and timelines may vary depending on your individual circumstances.

| Financial Goal | Description | Typical Timeline | Example |

|---|---|---|---|

| Emergency Fund | Saving to cover unexpected expenses, such as medical bills or job loss. | 3-6 months of living expenses | Saving $6,000 over 6 months (assuming $1,000 monthly expenses). |

| Pay Off High-Interest Debt | Eliminating debt like credit card balances to reduce interest payments. | Varies depending on the debt amount and repayment strategy | Paying off a $3,000 credit card balance within 18 months by allocating an extra $167 per month. |

| Down Payment on a House | Saving for the initial payment required to purchase a property. | 1-5 years or more | Saving $20,000 for a down payment over 3 years by contributing $555.56 monthly. |

| Retirement Savings | Accumulating funds to support your lifestyle after you stop working. | Decades | Contributing 10% of your annual salary to a 401(k) plan over 30 years. |

| Saving for a Vacation | Setting aside money for travel and leisure activities. | 6-18 months | Saving $3,000 for a trip to Europe over 12 months, requiring a monthly contribution of $250. |

Tracking Income and Expenses

Accurately tracking your income and expenses is the cornerstone of effective budgeting. It provides a clear picture of where your money comes from and where it goes, allowing you to make informed financial decisions. This process enables you to identify spending patterns, pinpoint areas for potential savings, and ultimately, gain control of your finances. Without this crucial step, your budget is essentially a shot in the dark.

Methods for Tracking Income

Tracking your income involves meticulously documenting all sources of money coming into your possession. This information is critical for comparing against your planned budget and understanding your financial inflows.

- Pay Stubs: Keep all pay stubs from your employer. They provide a detailed breakdown of your gross income, deductions (taxes, insurance, retirement contributions), and net income (the amount you actually receive).

- Bank Statements: Review your bank statements regularly to identify direct deposits, transfers, and any other income sources, such as interest earned on savings accounts or dividends from investments.

- Freelance and Self-Employment Income: If you have freelance or self-employment income, meticulously track all invoices sent and payments received. This is crucial for accurate income reporting and tax preparation.

- Other Income Sources: Don’t forget to document any other income, such as rental income, alimony, child support, or gifts.

Strategies for Categorizing Expenses Effectively

Categorizing your expenses is essential for understanding where your money is going. This allows you to analyze your spending habits and identify areas where you can cut back. Choosing a good categorization system makes the tracking process easier and the resulting analysis more insightful.

- Create Broad Categories: Start with broad categories to simplify the initial tracking process. Common categories include: Housing (rent/mortgage, utilities), Transportation (car payments, gas, public transport), Food (groceries, dining out), Entertainment (movies, concerts, hobbies), Healthcare (insurance, medical bills), Personal Care (haircuts, toiletries), Debt Payments (credit cards, loans), and Savings & Investments.

- Sub-categorize as Needed: Once you’ve established your broad categories, you can create subcategories for more detailed analysis. For example, under “Food,” you might have “Groceries,” “Dining Out,” and “Coffee Shops.”

- Be Consistent: Consistently assign each expense to the same category. This ensures accurate data and meaningful analysis.

- Review and Adjust: Regularly review your categories and make adjustments as needed. If a category becomes too large or doesn’t accurately reflect your spending, consider creating subcategories or merging categories.

Tools and Techniques for Expense Tracking

Several tools and techniques can help you track your expenses effectively. The best choice depends on your personal preferences and financial situation.

- Spreadsheets: Spreadsheets, like Microsoft Excel or Google Sheets, offer flexibility and customization. You can create your own expense tracking templates or use pre-designed templates. This option is suitable for those who prefer manual data entry and detailed control.

- Budgeting Apps: Budgeting apps, such as Mint, YNAB (You Need a Budget), and Personal Capital, automatically track your expenses by connecting to your bank accounts and credit cards. They often provide visual representations of your spending and offer budgeting features.

- Manual Tracking with a Notebook: For those who prefer a low-tech approach, a notebook and pen work perfectly well. Record each expense as it occurs, along with the date, amount, and category.

- Receipt Management: Regardless of the method you choose, keep receipts for all your purchases. They provide proof of your spending and can be useful if you need to reconcile your accounts. Consider using a receipt scanner app to digitize your receipts and reduce clutter.

Sample Expense Tracking Spreadsheet

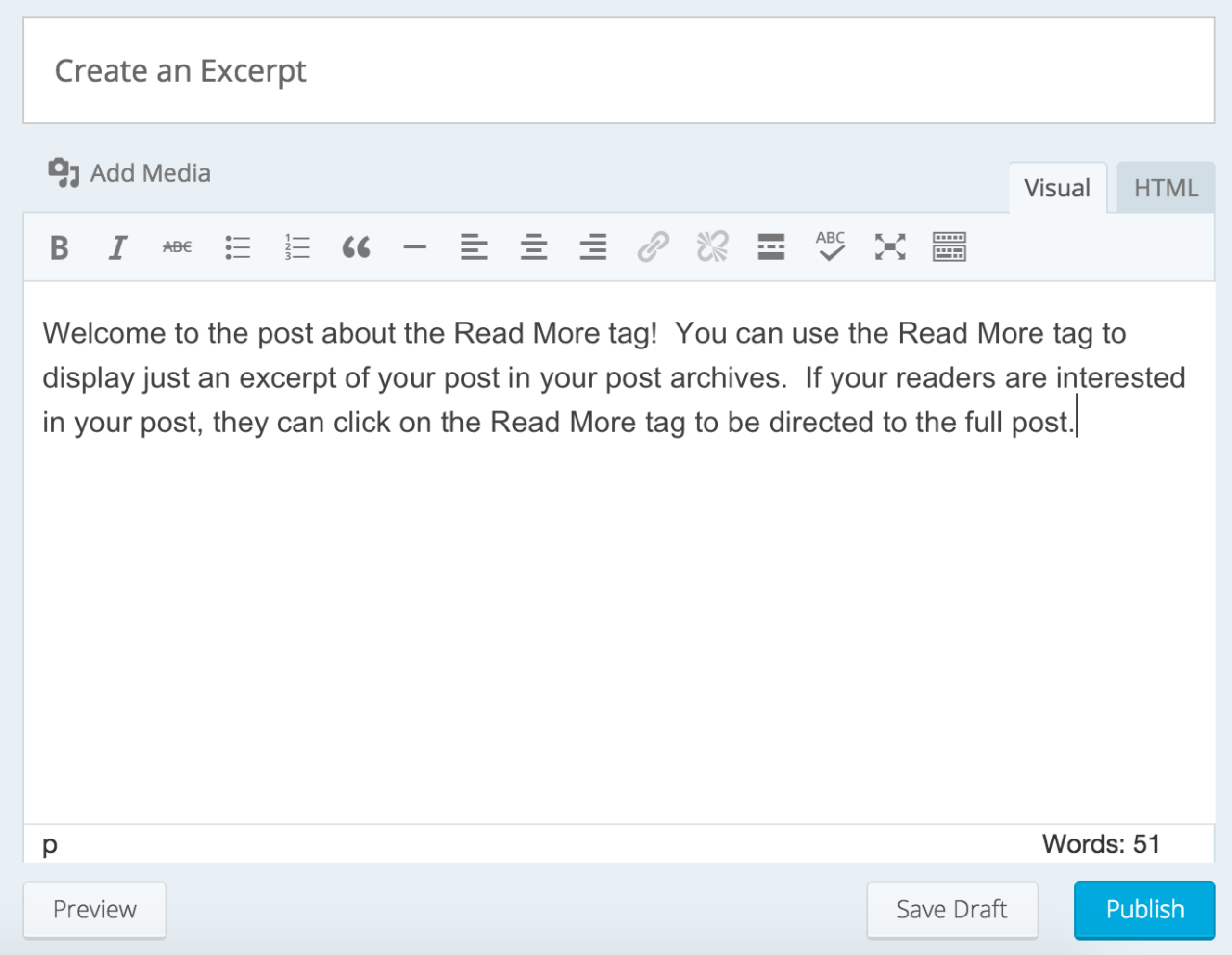

Here’s an example of a basic expense tracking spreadsheet using Google Sheets:

| Date | Description | Category | Amount |

|---|---|---|---|

| 2024-01-15 | Grocery Shopping | Food – Groceries | $75.00 |

| 2024-01-16 | Gas | Transportation | $40.00 |

| 2024-01-17 | Lunch with Friends | Food – Dining Out | $25.00 |

| 2024-01-18 | Netflix Subscription | Entertainment | $15.00 |

| 2024-01-19 | Rent | Housing | $1200.00 |

This table is a simplified representation. A more comprehensive spreadsheet would include columns for income, the month, and perhaps a column to mark whether the expense is recurring. It would also include formulas to calculate totals for each category and overall spending.

Identifying Areas for Potential Savings Based on Expense Tracking

Once you’ve tracked your income and expenses for a month or two, you can analyze the data to identify areas where you can potentially save money. This analysis involves comparing your spending to your budget (which you’ll create in the next step) and looking for opportunities to reduce expenses.

- Identify High-Spending Categories: Review your expense categories and identify the ones where you spend the most money. These are the areas to focus on first.

- Analyze Spending Patterns: Look for patterns in your spending. Do you frequently dine out? Are you spending a lot on entertainment? Understanding your habits can reveal opportunities for change.

- Compare Spending to Budget (if you have one): If you have a budget, compare your actual spending to your budgeted amounts. Identify any categories where you exceeded your budget.

- Look for Recurring Expenses: Review your recurring expenses, such as subscriptions and memberships. Are there any you can cancel or downgrade?

- Consider Small Changes: Even small changes can add up over time. For example, bringing your lunch to work instead of eating out can save a significant amount of money each month. Switching to a cheaper cell phone plan can also make a difference.

For instance, let’s say your expense tracking reveals that you spend $300 per month on dining out. By cutting back to $150 per month, you could save $150 per month, or $1800 per year. This extra money could be used to pay down debt, build an emergency fund, or invest for the future.

The 50/30/20 Budgeting Rule

The 50/30/20 budgeting rule is a simple and effective way to manage your money. It provides a clear framework for allocating your income, making it easier to track spending and achieve your financial goals. This method categorizes your spending into three main areas, allowing for a balanced approach to financial management.

Understanding the 50/30/20 Rule

The 50/30/20 rule suggests dividing your after-tax income into three categories: needs, wants, and savings/debt repayment. This structure provides a guideline for how to allocate your income, helping you stay on track with your finances.* Needs (50%): This category covers essential expenses that you must pay to live. These are the fundamental costs of life.

Housing

Rent or mortgage payments.

Utilities

Electricity, water, gas.

Food

Groceries and essential food items.

Transportation

Car payments, public transport, fuel.

Healthcare

Insurance premiums and medical expenses.

Minimum debt payments

The required payments on loans.

Wants (30%)

This category includes discretionary spending, things that enhance your life but aren’t essential.

Entertainment

Movies, concerts, dining out.

Hobbies

Costs associated with your hobbies.

Travel

Vacations and leisure trips.

Subscription services

Streaming services, magazines.

Dining out

Meals at restaurants.

Non-essential shopping

Clothes, gadgets, etc.

Savings and Debt Repayment (20%)

This category focuses on your financial future and includes saving for emergencies, retirement, and paying down debt.

Savings

Emergency fund, investment accounts.

Debt repayment

Paying down debts beyond the minimum payments.

Allocating Income with the 50/30/20 Rule: Examples

Let’s consider a few examples to illustrate how the 50/30/20 rule works in practice. These examples will show how to allocate a monthly income of $3,000 and $6,000, respectively.* Example 1: Monthly Income of $3,000 Based on the 50/30/20 rule:

Needs

50% of $3,000 = $1,500

Wants

30% of $3,000 = $900

Savings/Debt Repayment

20% of $3,000 = $600 This allocation provides a clear framework for managing expenses and building savings.* Example 2: Monthly Income of $6,000 Based on the 50/30/20 rule:

Needs

50% of $6,000 = $3,000

Wants

30% of $6,000 = $1,800

Savings/Debt Repayment

20% of $6,000 = $1,200 This allocation allows for greater spending on wants and a larger allocation to savings and debt repayment.

Pros and Cons of the 50/30/20 Rule

The 50/30/20 rule has both advantages and disadvantages. Understanding these can help you determine if it’s the right budgeting method for you.* Pros:

Simplicity

The rule is easy to understand and implement.

Flexibility

It allows for some flexibility in spending.

Balanced approach

It balances needs, wants, and savings.

Focus on savings

It encourages saving and debt repayment.

Adaptability

It can be adapted to various income levels.

Cons

May be challenging for low incomes

It can be difficult to meet needs within 50% of income with lower earnings.

Doesn’t account for all expenses

It may not fit specific financial situations, such as high medical bills or unusual expenses.

Requires discipline

Adhering to the rule requires discipline and consistent tracking.

Doesn’t specify savings goals

It does not provide specific savings targets.

May require adjustments

The percentages may need adjustment depending on individual circumstances.

Visual Representation: Pie Chart of the 50/30/20 Rule

The 50/30/20 rule can be visualized using a pie chart. This chart clearly illustrates the allocation of income across the three categories.The pie chart is divided into three sections:* 50% (Needs): This is the largest section, representing the portion of income dedicated to essential expenses. The section is often colored blue.

30% (Wants)

This section is smaller than the needs section, indicating that a smaller portion of the income is spent on discretionary items. This section is often colored green.

20% (Savings/Debt Repayment)

This section represents the portion of income allocated to savings and paying down debt. It’s often colored red, signaling financial growth and security.The pie chart visually demonstrates the balance of the budgeting rule. It emphasizes the importance of allocating a significant portion of your income to essential needs while still allowing for some discretionary spending and prioritizing savings and debt reduction.

This clear visual representation makes it easy to understand and implement the 50/30/20 budgeting rule.

Different Budgeting Methods

Choosing the right budgeting method is crucial for financial success. Different methods cater to different personalities, spending habits, and financial goals. Understanding the pros and cons of each allows you to select the one that best fits your needs and helps you achieve your financial objectives.

Comparing Budgeting Methods

Several budgeting methods exist, each with unique strengths and weaknesses. Here’s a comparison of some popular options:

| Budgeting Method | Description | Pros | Cons | Best For |

|---|---|---|---|---|

| Zero-Based Budgeting | Every dollar is assigned a purpose; income minus expenses equals zero. | Highly detailed, promotes awareness, maximizes savings. | Time-consuming, requires meticulous tracking, can be inflexible. | Individuals seeking complete control over their finances, those with fluctuating incomes. |

| Envelope Budgeting | Cash is allocated to specific categories in physical envelopes. | Simple, visual, limits overspending, helps avoid debt. | Requires cash, can be inconvenient, doesn’t track digital spending. | Individuals who struggle with overspending, those who prefer a visual approach. |

| 50/30/20 Budgeting | 50% of income for needs, 30% for wants, 20% for savings and debt repayment. | Easy to understand, flexible, good for beginners. | Less detailed, may not be suitable for all income levels. | Beginners, those seeking a simple budgeting approach. |

| Percentage-Based Budgeting | Income is divided into percentages allocated to different categories. | Adaptable, flexible, can be automated. | Requires accurate income tracking, needs periodic adjustments. | Individuals who want a simple, automated approach. |

Creating a Zero-Based Budget

Zero-based budgeting involves allocating every dollar of your income to a specific purpose. This method ensures that your income minus your expenses always equals zero, meaning every dollar is accounted for, either spent, saved, or invested.The steps to create a zero-based budget are:

- Calculate Your Income: Determine your total monthly income after taxes. Include all sources of income, such as salary, wages, and any other regular income streams.

- List Your Expenses: Categorize your expenses. Include both fixed expenses (rent, mortgage, utilities) and variable expenses (groceries, entertainment, dining out). Be as detailed as possible.

- Allocate Your Income: Assign every dollar to a specific category. Subtract your expenses from your income. If the result is not zero, adjust your spending or find areas to cut costs until it reaches zero.

- Track Your Spending: Monitor your spending throughout the month to ensure you stay within your budget. Use budgeting apps, spreadsheets, or notebooks to track your expenses.

- Review and Adjust: At the end of the month, review your budget and compare it to your actual spending. Make adjustments for the following month based on your findings. This is an ongoing process.

For example, if your monthly income is $4,000 and your expenses are $3,800, you’d allocate the remaining $200 to savings, debt repayment, or another financial goal, ensuring that your budget balances to zero.

Implementing Envelope Budgeting

Envelope budgeting is a cash-based system designed to control spending by allocating physical cash to specific categories in envelopes. This method provides a visual and tangible way to manage your money, making it easier to stick to your budget.Here’s how to implement envelope budgeting:

- Determine Your Categories: Identify the spending categories where you tend to overspend, such as groceries, dining out, entertainment, or personal care.

- Calculate Your Budget for Each Category: Determine how much money you want to allocate to each category each month.

- Withdraw Cash: At the beginning of each month, withdraw the allocated amount of cash for each category.

- Label Your Envelopes: Label an envelope for each category (e.g., “Groceries,” “Dining Out,” “Entertainment”).

- Distribute Cash: Place the cash for each category into its corresponding envelope.

- Spend Cash Only: When you need to spend money in a particular category, use only the cash from that envelope. Once the cash is gone, you can’t spend any more in that category for the month.

- Track Your Spending: While using cash, it’s helpful to track your spending within each category to stay aware of how much you’ve spent.

- Monitor and Adjust: At the end of the month, assess how well you stuck to your budget. Adjust the amounts allocated to each envelope for the following month based on your spending habits.

For instance, if you allocate $400 for groceries, you would put $400 in your “Groceries” envelope. When shopping for groceries, you would only use the cash from that envelope. If you run out of cash before the end of the month, you’ll need to adjust your spending habits or move money from another envelope (if possible).

Best Budgeting Methods Based on User Needs

Different individuals have different needs, and the best budgeting method depends on those needs. Here’s a breakdown:

- For Beginners: The 50/30/20 method is often the easiest to understand and implement. Its simplicity makes it an excellent starting point.

- For Those Who Overspend: Envelope budgeting is highly effective because it provides a physical limit on spending, making it difficult to overspend.

- For Those Seeking Maximum Control: Zero-based budgeting provides the most detailed control, as every dollar is assigned a specific purpose.

- For Those with Fluctuating Incomes: Zero-based budgeting allows for adjustments each month based on income variations.

- For Tech-Savvy Individuals: Percentage-based budgeting can be automated using budgeting apps and tools, making it easy to manage finances.

The 30-Day Trial Challenge

Now that you understand the fundamentals of budgeting, it’s time to put your knowledge into action! The 30-Day Trial Challenge is a practical, hands-on exercise designed to help you implement the budgeting strategies we’ve discussed and experience the positive impact of financial planning firsthand. This challenge is a commitment to yourself, a dedicated period to track your spending, analyze your habits, and build a foundation for long-term financial success.

Purpose and Benefits of the 30-Day Trial Challenge

The primary purpose of the 30-Day Trial Challenge is to foster financial awareness and establish healthy budgeting habits. It offers several key benefits.

- Enhanced Financial Awareness: By diligently tracking your income and expenses, you’ll gain a clear understanding of where your money is going. This increased awareness is the first step toward making informed financial decisions.

- Improved Spending Habits: The challenge encourages you to be mindful of your spending choices. You’ll begin to identify areas where you can cut back and allocate funds more effectively.

- Goal Setting and Achievement: The challenge provides a structured framework for setting and working towards your financial goals, whether it’s saving for a down payment, paying off debt, or simply building an emergency fund.

- Reduced Financial Stress: By taking control of your finances, you’ll experience a significant reduction in financial stress and anxiety. Knowing where your money is going and having a plan for the future brings peace of mind.

- Development of Budgeting Skills: The 30-day trial is an excellent opportunity to practice and refine your budgeting skills, preparing you for long-term financial success.

Step-by-Step Guide to Begin the Challenge

Starting the 30-Day Trial Challenge requires a clear plan and a commitment to consistent effort. Here’s a step-by-step guide to get you started:

- Choose Your Budgeting Method: Decide which budgeting method you’ll use (50/30/20, zero-based, envelope budgeting, etc.) based on your financial situation and preferences. Refer back to the section on “Different Budgeting Methods” for guidance.

- Set Your Financial Goals: Define specific, measurable, achievable, relevant, and time-bound (SMART) financial goals. For example, “Save $200 for an emergency fund within 30 days.”

- Track Your Income: Accurately record all sources of income, including salary, freelance earnings, or any other money you receive.

- Track Your Expenses: Meticulously track all your expenses, categorizing them according to your chosen budgeting method. Use a budgeting app, spreadsheet, or notebook to record every transaction.

- Analyze Your Spending: At the end of each week, review your spending habits. Identify areas where you’re overspending and where you can make adjustments.

- Make Adjustments: Based on your analysis, make necessary adjustments to your budget. This might involve cutting back on certain expenses or reallocating funds.

- Stay Consistent: Stick to your budget as closely as possible. Consistency is key to the success of the challenge.

- Review and Adjust: At the end of the 30 days, review your progress. Identify what worked well and what didn’t. Use this information to refine your budget and continue improving your financial habits.

Tips for Staying Motivated During the Challenge

Maintaining motivation throughout the 30-Day Trial Challenge requires commitment and a few strategies to keep you on track.

- Set Realistic Goals: Start with achievable goals. Avoid setting overly ambitious targets that could lead to discouragement.

- Celebrate Small Wins: Acknowledge and celebrate your progress, no matter how small. This reinforces positive behavior and keeps you motivated.

- Find an Accountability Partner: Share your progress with a friend or family member. Having someone to support you and hold you accountable can be highly effective.

- Use Budgeting Tools: Leverage budgeting apps, spreadsheets, or online tools to simplify the tracking process and provide visual representations of your progress.

- Reward Yourself (Responsibly): When you reach milestones, reward yourself with something that aligns with your financial goals. For example, if you save $100, treat yourself to a small, affordable reward.

- Stay Positive: Remember that the challenge is a learning experience. Don’t get discouraged by setbacks. Learn from your mistakes and keep moving forward.

- Visualize Your Success: Regularly visualize yourself achieving your financial goals. This mental exercise can strengthen your commitment and drive.

Checklist for the First Week of the 30-Day Challenge

To ensure a successful start to the challenge, use this checklist for the first week:

- Choose your Budgeting Method and Budgeting Tool: Select the method that best suits your needs and choose a budgeting app, spreadsheet, or notebook.

- Set Your Financial Goals: Define your financial goals.

- Track All Income: Record all sources of income for the week.

- Track All Expenses: Meticulously record every expense, categorizing them appropriately.

- Review Your Spending Daily: At the end of each day, review your spending to identify any areas of concern.

- Analyze Your Spending at the End of the Week: Review all spending for the week.

- Make Adjustments if Necessary: Make any necessary adjustments to your budget for the following week.

Adjusting Your Budget During the Challenge

The 30-Day Trial Challenge is a dynamic process, not a set-it-and-forget-it exercise. You’ll likely discover areas where your initial budget needs tweaking as you track your spending and learn more about your habits. This section will guide you through adjusting your budget based on your findings, handling unexpected expenses, and finding extra money to save.

Adapting Your Budget Based on Initial Findings

After a week or two of tracking your income and expenses, you’ll have a clearer picture of your spending patterns. This is the time to compare your actual spending with your planned budget and make necessary adjustments.

- Identify Spending Surprises: Review your spending categories. Did you spend more than anticipated on groceries, entertainment, or eating out? Did you underestimate fixed expenses like utilities or transportation?

- Analyze the Data: Use your tracking method (spreadsheet, app, etc.) to analyze where your money is actually going. Look for trends and areas where you can potentially cut back. For example, if you find you’re spending $100 per week on eating out when you budgeted $50, you have a clear area to address.

- Revise Your Budget: Based on your analysis, revise your budget. This might involve increasing some categories (e.g., groceries) and decreasing others (e.g., entertainment). Be realistic about your spending habits.

- Set Realistic Goals: If you’re consistently overspending in a particular category, don’t try to drastically cut it overnight. Instead, set smaller, achievable goals. For example, if you spend $100 weekly on dining out, aim to reduce it to $90 in the first week, then $80 the next, and so on.

Strategies for Dealing with Unexpected Expenses

Unexpected expenses are inevitable. Car repairs, medical bills, or sudden home maintenance needs can throw a wrench into your carefully planned budget. Having strategies in place will help you navigate these situations without derailing your financial goals.

- Emergency Fund: The best defense against unexpected expenses is an emergency fund. Aim to save at least three to six months’ worth of living expenses. This fund can be used to cover unexpected costs without going into debt or disrupting your budget.

- Prioritize Expenses: When an unexpected expense arises, prioritize your spending. Determine which expenses are essential and which are discretionary. Essential expenses (housing, food, utilities) should be covered first.

- Look for Cost-Cutting Opportunities: If you face an unexpected expense, identify areas where you can temporarily cut back on spending. This could involve reducing entertainment costs, eating out less, or postponing non-essential purchases.

- Consider Financing Options Carefully: If the unexpected expense is significant and you don’t have enough in your emergency fund, explore financing options cautiously. Compare interest rates and terms before taking out a loan or using a credit card. Avoid high-interest debt if possible.

- Example: Imagine your car needs a $500 repair. If you have an emergency fund, you can use it to cover the cost. If not, you might need to cut back on entertainment or delay a non-essential purchase to cover the expense.

Finding Extra Money to Save During the Trial

Even during a 30-day trial, there are opportunities to find extra money to save. These savings can be used to accelerate debt repayment, boost your emergency fund, or simply get ahead financially.

- Review Subscriptions and Memberships: Take stock of all your subscriptions (streaming services, gym memberships, etc.). Are you using them all? Can you cancel any that you don’t need or use frequently? Even small savings add up.

- Cut Back on Discretionary Spending: Identify areas where you can temporarily reduce discretionary spending. This might include eating out less, reducing your entertainment budget, or postponing non-essential purchases.

- Sell Unused Items: Look around your home for items you no longer use or need. Sell them online (eBay, Craigslist, Facebook Marketplace) or at a consignment shop. The proceeds can go directly into savings.

- Negotiate Bills: Contact your service providers (internet, cable, phone) and see if you can negotiate a lower rate. Many companies are willing to offer discounts to retain customers.

- Take on a Side Hustle: Consider taking on a temporary side hustle to earn extra income. This could involve freelancing, driving for a ride-sharing service, or doing odd jobs.

- Example: Suppose you find you’re paying $30 per month for a streaming service you rarely use. Canceling it saves you $360 per year.

Analyzing Spending Habits and Adjusting Accordingly

Analyzing your spending habits is a crucial part of making informed budget adjustments. Understanding where your money goes allows you to make conscious choices and align your spending with your financial goals.

- Identify Spending Triggers: What situations or emotions lead you to overspend? Are you more likely to spend money when you’re stressed, bored, or celebrating? Recognizing your triggers helps you develop strategies to avoid impulsive spending.

- Track Your Emotions: Keep a spending diary and note your emotional state when you make a purchase. This can help you identify patterns and triggers.

- Use Data to Inform Decisions: The data from your tracking method is invaluable. Review your spending regularly to identify areas where you’re overspending.

- Set Limits: Set spending limits for specific categories or individual purchases. For example, you might set a weekly limit for dining out or a maximum amount you’re willing to spend on clothes.

- Reward System: Consider creating a reward system for sticking to your budget. This could be a small treat or a non-monetary reward, like an extra hour of relaxation.

- Example: If you find you often overspend on impulse buys while online shopping, you could delete your saved credit card information, unsubscribe from promotional emails, or create a “cooling-off” period before making a purchase.

Overcoming Budgeting Obstacles

Budgeting is a journey, and like any journey, it can have its bumps along the road. Many people find themselves facing challenges that can derail their budgeting efforts. Understanding these obstacles and having strategies to overcome them is crucial for long-term financial success. This section provides practical solutions to common budgeting hurdles, equipping you with the tools you need to stay on track.

Common Budgeting Challenges and Solutions

Budgeting is not always easy. Several common challenges can make sticking to a budget difficult. However, with awareness and the right strategies, these obstacles can be overcome.

- Lack of Motivation: Staying motivated can be tough. Many people start strong, but lose interest.

Solution: Regularly review your goals and celebrate small wins. Remind yourself why you started budgeting in the first place. Break down large financial goals into smaller, achievable milestones.

Visualize your success. For example, if your goal is to save for a down payment on a house, create a vision board with images of your dream home and place it in a visible location.

- Difficulty Tracking Expenses: Accurately tracking where your money goes is essential for a successful budget.

Solution: Use budgeting apps, spreadsheets, or notebooks to record expenses. Set aside time each day or week to update your records. Categorize your spending to identify areas where you can cut back. Consider linking your bank accounts to a budgeting app to automate expense tracking.

For instance, apps like Mint or YNAB (You Need a Budget) can automatically categorize transactions, saving you time and effort.

- Unexpected Expenses: Life is unpredictable, and unexpected costs will inevitably arise.

Solution: Build an emergency fund to cover unexpected expenses. Allocate a portion of your budget to a “miscellaneous” or “buffer” category. When an unexpected expense occurs, use funds from your emergency fund or miscellaneous category instead of derailing your entire budget. Aim to save 3-6 months’ worth of living expenses in your emergency fund.

If an unexpected car repair costs $500, use funds from your emergency fund, and then replenish the fund over time by slightly reducing spending in other categories.

- Overspending: It’s easy to overspend, especially in categories like entertainment or dining out.

Solution: Set clear spending limits for each category. Use the envelope method, where you allocate cash to different spending categories and only spend what’s in the envelope. Review your spending regularly to identify areas where you’re overspending. If you find yourself frequently overspending on dining out, consider packing lunches more often or finding less expensive restaurants.

Consider implementing the 24-hour rule before making non-essential purchases: if you still want the item after 24 hours, you can buy it.

- Inconsistent Budgeting: Not sticking to your budget consistently can lead to failure.

Solution: Make budgeting a habit. Schedule time each week or month to review and update your budget. Automate bill payments to ensure they’re paid on time. Use budgeting apps that send notifications when you’re nearing your spending limits.

Consistency is key. Even small, consistent efforts can lead to significant financial progress over time. If you consistently review your budget every Sunday evening, you’re more likely to stay on track.

Strategies for Dealing with Debt

Debt can be a major obstacle to financial freedom. Effective debt management is essential for improving your financial health. There are several proven strategies for tackling debt.

- Debt Snowball Method: This method involves listing your debts from smallest to largest, regardless of interest rate. You pay the minimum payment on all debts except the smallest one, which you aggressively pay down. Once the smallest debt is paid off, you move on to the next smallest, and so on.

This approach provides psychological wins, as you see debts paid off quickly, which can help you stay motivated.

For example, if you have debts of $500, $1,000, and $2,000, you would focus on paying off the $500 debt first, then the $1,000, and finally the $2,000.

- Debt Avalanche Method: This method focuses on paying off debts with the highest interest rates first, regardless of the balance. You pay the minimum payment on all debts except the one with the highest interest rate, which you aggressively pay down.

This approach saves you the most money in the long run because it minimizes the amount of interest you pay. For instance, if you have debts with interest rates of 5%, 10%, and 15%, you would prioritize paying off the debt with the 15% interest rate first.

- Debt Consolidation: This involves combining multiple debts into a single loan, often with a lower interest rate. This can simplify your payments and potentially save you money on interest.

Options include balance transfers to a credit card with a lower introductory interest rate or taking out a personal loan. Before consolidating, carefully compare interest rates and fees to ensure it’s a beneficial move.

If you have multiple credit card debts with high interest rates, consolidating them into a single personal loan with a lower rate can significantly reduce your monthly payments and interest costs.

- Negotiating with Creditors: Contact your creditors and explain your financial situation. They may be willing to offer a lower interest rate, a reduced payment plan, or even waive some fees.

Be prepared to provide documentation of your income and expenses. For instance, if you’re struggling to make credit card payments, call your credit card company and ask if they can offer a hardship program or lower your interest rate.

Sometimes, creditors are willing to work with you to avoid defaults.

- Creating a Debt Repayment Plan: Develop a detailed plan that Artikels how you will pay off your debts. Include the amount you will pay each month, the order in which you will pay off your debts, and a timeline for repayment.

Track your progress and adjust your plan as needed. This plan should be integrated into your budget. For example, if you’re using the debt snowball method, clearly state the debts you’ll tackle in order and the monthly payments you’ll make on each.

This provides a clear roadmap to financial freedom.

Sticking to Your Budget During Financial Stress

Financial stress can make it difficult to stick to your budget. Having strategies to navigate financial hardship is crucial for maintaining control of your finances.

- Communicate Openly: Talk to your family or partner about your financial situation and your budget. Transparency can reduce stress and foster collaboration.

Sharing your financial goals and challenges with loved ones can lead to mutual support and understanding. If you are facing job loss, communicate this to your family and work together to adjust your budget and spending habits. This shared understanding helps in times of financial stress.

- Prioritize Needs Over Wants: During times of financial stress, focus on essential expenses like housing, food, and utilities. Cut back on discretionary spending.

Evaluate your budget and identify areas where you can reduce spending. Postpone non-essential purchases and look for ways to save money on essential expenses. For instance, if you’re struggling to pay your bills, prioritize them and consider cutting back on entertainment and dining out.

Cooking at home instead of eating out can significantly reduce expenses.

- Seek Professional Help: If you’re struggling to manage your finances, consider seeking help from a financial advisor or credit counselor. They can provide guidance and support.

They can help you create a budget, manage debt, and develop a plan to achieve your financial goals. Non-profit credit counseling agencies often offer free or low-cost services. A financial advisor can help you navigate complex financial situations.

For example, a financial advisor can help you develop a plan to address high-interest debt and create a budget that aligns with your income and expenses.

- Build an Emergency Fund: Having an emergency fund can provide a financial cushion during times of stress.

Aim to save at least 3-6 months’ worth of living expenses. This fund can cover unexpected expenses without disrupting your budget. Having an emergency fund allows you to handle unexpected events, such as job loss or medical bills, without going into debt. If you lose your job, your emergency fund can cover your essential expenses while you look for a new job, providing peace of mind during a stressful period.

- Focus on What You Can Control: While you can’t control external factors like the economy, you can control your spending habits and your financial decisions.

Concentrate on the actions you can take to improve your financial situation. This can include creating a budget, tracking your expenses, and paying down debt. When you’re feeling overwhelmed, focus on the small, manageable steps you can take to improve your financial health.

For example, even if the economy is down, you can still control your spending habits and pay down debt.

Troubleshooting Guide for Common Budgeting Problems

Budgeting is a learning process. Sometimes, things don’t go as planned. A troubleshooting guide can help you identify and fix common budgeting problems.

- Problem: Overspending in a specific category.

Solution: Review your spending in that category. Identify the areas where you’re overspending. Reduce spending in that category by setting stricter limits or cutting back on non-essential purchases. For instance, if you consistently overspend on dining out, track where the money is going, perhaps consider cooking at home more often, and limit restaurant visits to a certain number per month.

- Problem: Difficulty tracking expenses.

Solution: Choose a tracking method that works for you (budgeting app, spreadsheet, notebook). Make tracking a daily or weekly habit. Automate tracking where possible (linking bank accounts). If using a notebook, set aside time each day or week to record your expenses.

Use a budgeting app that automatically categorizes your transactions.

- Problem: Not enough money at the end of the month.

Solution: Review your budget and identify areas where you can cut back on spending. Increase your income by finding a side hustle or asking for a raise. Evaluate your spending habits and look for areas to reduce spending. If you find that your income is not sufficient to cover your expenses, explore options for increasing your income, such as taking on a part-time job or starting a side business.

- Problem: Lack of motivation to stick to the budget.

Solution: Set clear financial goals. Regularly review your progress and celebrate small wins. Remind yourself why you started budgeting in the first place. Create a vision board of your financial goals.

Post it in a visible location to stay motivated. Celebrate reaching milestones, such as paying off a debt or saving a certain amount of money.

- Problem: Unexpected expenses that throw off the budget.

Solution: Build an emergency fund to cover unexpected expenses. Allocate a portion of your budget to a “miscellaneous” or “buffer” category. Adjust your budget to accommodate the expense, if possible. If an unexpected expense arises, such as a car repair, use funds from your emergency fund.

Then, adjust your budget to replenish the emergency fund over time. If you have no emergency fund, look for ways to cut spending in other categories.

- Problem: Budgeting feels too restrictive.

Solution: Make sure your budget is realistic and allows for some flexibility. Allocate a portion of your budget to “fun money” or “discretionary spending.” Adjust your budget to reflect your lifestyle and priorities. If your budget feels too rigid, review it and make adjustments. Ensure that you allocate funds for activities and items that bring you joy.

Consider the 50/30/20 rule to balance needs, wants, and savings.

Reviewing and Refining Your Budget

Creating a budget is just the first step; the real work lies in consistently reviewing and refining it. Life throws curveballs, and your financial situation evolves. Regularly revisiting your budget ensures it remains a useful tool, helping you stay on track with your goals and adapt to changes. This section will guide you through the process of maintaining a dynamic and effective budget.

Importance of Regularly Reviewing the Budget

Regular budget reviews are essential for several reasons. They provide a clear snapshot of your financial health, allowing you to identify areas where you’re succeeding and where you might need to make adjustments. They also help you catch potential problems early on, such as overspending or unexpected expenses, before they derail your progress.

Frequency of Budget Reviews

How often you review your budget depends on your personal circumstances and financial complexity. However, a general guideline is to review your budget at least monthly. For some, especially those with fluctuating income or significant financial changes, a weekly or bi-weekly review might be more beneficial. The key is to find a frequency that works for you and allows you to stay informed and in control.

Strategies for Adjusting the Budget Based on Changing Circumstances

Life is unpredictable, and your budget should reflect that. Here are some strategies for adjusting your budget when your circumstances change:

- Track Your Spending: Continue tracking your income and expenses meticulously. This provides the data needed to identify trends and areas needing adjustment.

- Analyze the Data: Look for patterns in your spending. Are you consistently overspending in certain categories? Are there areas where you could cut back?

- Prioritize Needs vs. Wants: When making adjustments, prioritize your needs over your wants. Ensure essential expenses like housing, food, and transportation are covered first.

- Re-evaluate Your Goals: Have your financial goals changed? Are you saving for a new car, a down payment on a house, or early retirement? Adjust your budget to align with your current goals.

- Consider Income Changes: If your income increases, decide how to allocate the extra funds. You could increase savings, pay down debt, or allocate more to discretionary spending. If your income decreases, you’ll need to make cuts to your spending.

- Be Flexible: Life happens. Unexpected expenses, like a medical bill or a car repair, will arise. Have an emergency fund to cover these costs without disrupting your budget. If the expense is substantial, adjust other areas to compensate.

- Review and Revise Regularly: Make budget reviews a habit. Schedule them into your calendar. Don’t be afraid to make changes as needed.

Monthly Budget Review Checklist

This checklist will help you systematically review your budget each month. Print it out or save it digitally to track your progress.

| Task | Details | Status |

|---|---|---|

| Review Income | Compare actual income to budgeted income. Identify any discrepancies. | |

| Review Expenses | Compare actual expenses to budgeted expenses for each category. | |

| Identify Overspending | Note any categories where you exceeded your budget. Determine the cause. | |

| Identify Underspending | Note any categories where you spent less than budgeted. | |

| Adjust Budget (if needed) | Make necessary adjustments to spending categories based on your review. | |

| Track Progress Towards Goals | Review your progress on savings, debt repayment, or other financial goals. | |

| Update Financial Tracker | Update your spreadsheet or budgeting app with the latest data and any changes. | |

| Plan for Next Month | Anticipate upcoming expenses and make adjustments to your budget accordingly. |

Important Note: Remember that budgeting is a process, not a destination. It’s about continuous learning and adaptation. Be patient with yourself, and don’t be discouraged by setbacks. The more you practice, the better you’ll become at managing your finances.

Budgeting Tools and Resources

Having the right tools and resources can significantly streamline the budgeting process, making it less daunting and more effective. Whether you prefer a digital approach or a more traditional method, there’s a wealth of options available to help you manage your finances. This section explores popular budgeting apps, software, and online resources to empower you to take control of your money.

Popular Budgeting Apps and Software

Budgeting apps and software offer a convenient way to track income, expenses, and savings. They often provide features like automatic transaction imports, budgeting templates, and financial reports. Here are some of the most popular options:

- Mint: A free app that connects to your bank accounts, automatically categorizes transactions, and allows you to create budgets and track your progress. It also offers credit score monitoring and investment tracking.

- YNAB (You Need a Budget): A paid budgeting software based on the zero-based budgeting method. It emphasizes giving every dollar a job, tracking your spending, and planning for the future.

- Personal Capital: A free app that provides financial dashboards, investment tracking, and retirement planning tools. It also offers financial advisors for personalized advice.

- PocketGuard: An app that connects to your accounts and helps you see how much “safe-to-spend” money you have after budgeting for your bills and goals.

- EveryDollar: A budgeting app created by Dave Ramsey, based on the zero-based budgeting method. It allows you to create a budget, track your expenses, and set financial goals. There’s a free and a paid version.

- Goodbudget: A budgeting app based on the envelope budgeting system. It allows you to allocate funds to different spending categories (envelopes) and track your spending in each category. There’s a free and a paid version.

Comparison of Free Versus Paid Budgeting Tools

Choosing between free and paid budgeting tools depends on your individual needs and preferences. Free tools offer a cost-effective way to get started, while paid tools often provide more advanced features and support.

- Free Tools: Free budgeting apps like Mint and Personal Capital offer a good starting point for beginners. They typically provide basic budgeting features, transaction tracking, and some financial reporting. The main advantage is the cost; however, they may have limited features, rely on advertising, or offer fewer support options. They can be a great way to get familiar with budgeting without any financial commitment.

- Paid Tools: Paid budgeting software, such as YNAB, often provides more comprehensive features, like advanced budgeting methods (zero-based, envelope), more robust reporting, and personalized support. They may also offer integrations with other financial services and remove advertisements. While there is a cost involved, paid tools can be worth the investment if you need more advanced features or personalized support. They may offer more in-depth insights into your spending habits and help you achieve your financial goals more effectively.

Helpful Online Resources for Budgeting

Beyond budgeting apps, there are numerous online resources that can help you learn more about budgeting and manage your finances effectively.

- Personal Finance Blogs: Websites like The Balance, NerdWallet, and Investopedia offer articles, guides, and tools on a wide range of personal finance topics, including budgeting. They provide expert advice, practical tips, and helpful resources to improve your financial literacy.

- Financial Calculators: Many websites offer financial calculators that can help you estimate loan payments, calculate savings goals, and plan for retirement. Use these tools to gain insights into your financial situation and make informed decisions.

- Government Resources: Government websites, such as the Consumer Financial Protection Bureau (CFPB), offer educational resources and tools to help you manage your finances. These resources provide reliable information and guidance on budgeting, saving, and debt management.

- YouTube Channels: Numerous YouTube channels provide budgeting tips, financial advice, and tutorials on using budgeting apps and software. Channels like The Budget Mom and The Financial Diet offer valuable insights and practical strategies for managing your money.

Table Comparing Features of Different Budgeting Apps

The following table provides a comparison of features offered by several popular budgeting apps. This can help you choose the best tool for your specific needs.

| Feature | Mint | YNAB | Personal Capital | PocketGuard |

|---|---|---|---|---|

| Cost | Free | Paid Subscription | Free | Free & Paid Subscription |

| Automatic Transaction Import | Yes | Yes | Yes | Yes |

| Budgeting Method | Categorization-based | Zero-based | Categorization-based | Safe-to-Spend |

| Investment Tracking | Yes | No | Yes | No |

| Financial Reporting | Yes | Yes | Yes | Yes |

| Credit Score Monitoring | Yes | No | No | No |

Building Good Financial Habits

Building good financial habits is essential for long-term financial success. These habits are the foundation upon which you build your financial security, helping you navigate unexpected expenses, achieve your financial goals, and create a more secure future. It’s not about making drastic changes overnight, but about consistently implementing small, positive actions that compound over time.

Importance of Long-Term Financial Habits

Developing and maintaining good financial habits is crucial for several reasons. These habits provide a framework for managing your money effectively, leading to increased financial stability and peace of mind. Consistent application of these habits enables you to weather financial storms, take advantage of opportunities, and ultimately, reach your financial aspirations.

Strategies for Saving Money Consistently

Consistent saving is the cornerstone of financial security. It’s not just about saving a large sum at once; it’s about making saving a regular part of your financial routine.* Automate Your Savings: Set up automatic transfers from your checking account to your savings account each month. This removes the temptation to spend the money and ensures you’re saving consistently.

Track Your Spending

Use budgeting apps, spreadsheets, or notebooks to monitor where your money is going. This awareness helps you identify areas where you can cut back and save more.

Set Savings Goals

Having specific, measurable, achievable, relevant, and time-bound (SMART) goals provides motivation. For example, aim to save $5,000 for a down payment on a house within three years.

Find Ways to Reduce Expenses

Look for areas where you can cut back on spending, such as dining out, entertainment, or subscriptions. Even small reductions can add up over time.

Embrace the Power of Compound Interest

The longer you save, the more your money grows due to compound interest. This means you earn interest not only on your initial savings but also on the interest you’ve already earned.

Compound Interest Formula: A = P(1 + r/n)^(nt) Where: A = the future value of the investment/loan, including interest P = the principal investment amount (the initial deposit or loan amount) r = the annual interest rate (as a decimal) n = the number of times that interest is compounded per year t = the number of years the money is invested or borrowed for

For instance, consider two scenarios: 1. You invest $1,000 at a 5% annual interest rate, compounded annually, for 10 years. The future value would be approximately $1,629. 2. You invest the same amount and interest rate for 30 years.

The future value skyrockets to approximately $4,322. The longer the investment period, the more significant the impact of compound interest.

Increase Your Income

Explore ways to increase your income, such as asking for a raise, taking on a side hustle, or starting a small business. The more income you have, the more you can save.

Tips for Making Smart Financial Decisions

Making smart financial decisions involves careful consideration, planning, and a proactive approach. It’s about balancing your current needs with your future goals.* Avoid Impulse Purchases: Before making a purchase, especially a large one, take time to consider whether you really need it. Wait a day or two to think about it before buying.

Research Before You Buy

Compare prices, read reviews, and understand the terms and conditions before making any significant purchase.

Negotiate Prices

Don’t be afraid to negotiate prices, especially for large purchases like a car or furniture.

Prioritize Needs Over Wants

Distinguish between essential expenses and discretionary spending. Focus on meeting your needs first, and then allocate what’s left to your wants.

Build an Emergency Fund

Having an emergency fund can help you avoid going into debt when unexpected expenses arise. Aim to save 3-6 months’ worth of living expenses.

Educate Yourself

Stay informed about financial matters. Read books, articles, and blogs, or take courses to enhance your financial literacy.

Financial Habits to Adopt for Long-Term Success

Adopting the following financial habits can significantly improve your long-term financial well-being.* Create a Budget and Stick to It: A budget is the foundation of good financial management. It helps you track your income and expenses, identify areas for improvement, and stay on track to meet your financial goals.

Track Your Spending

Regularly monitor where your money goes. This provides valuable insights into your spending habits and helps you make informed decisions.

Pay Bills on Time

Late payments can result in fees and damage your credit score. Set up automatic bill payments to avoid missing deadlines.

Save Regularly

Make saving a non-negotiable part of your financial plan. Automate your savings and set realistic goals.

Build an Emergency Fund

Have readily accessible funds to cover unexpected expenses, such as medical bills or job loss.

Manage Debt Wisely

Avoid unnecessary debt and prioritize paying off high-interest debt first.

Invest for the Future

Start investing early to take advantage of compound interest and grow your wealth over time.

Review and Adjust Your Budget Regularly

Financial situations and goals change over time. Review your budget at least quarterly and make adjustments as needed.

Protect Your Credit Score

Maintain a good credit score by paying bills on time, keeping credit card balances low, and avoiding opening too many new accounts at once.

Continuously Educate Yourself

Stay informed about financial matters to make smart decisions and adapt to changing economic conditions.

Seek Professional Advice When Needed

Don’t hesitate to consult with a financial advisor if you need help with complex financial planning.

Budgeting for Specific Life Events

Planning for life’s big moments requires a proactive approach to finances. Whether it’s a dream vacation, a wedding, or a significant purchase like a house, careful budgeting ensures you can enjoy these experiences without jeopardizing your financial stability. This section provides strategies and examples to help you navigate these financial milestones effectively.

Budgeting for Vacations and Travel

Vacations offer a chance to relax and create lasting memories. However, without a budget, travel expenses can quickly spiral out of control. Creating a vacation budget involves several key steps.

- Determine Your Travel Dates and Destination: These factors significantly impact costs. Peak season travel often incurs higher prices for flights and accommodations.

- Research and Estimate Expenses: Consider flights, accommodation, transportation (rental car, public transit), food, activities, and souvenirs. Use websites like Kayak, Expedia, and TripAdvisor to compare prices. For example, a week-long trip to Paris might include:

- Flights: $800 – $1,200 (depending on the departure city and time of year)

- Accommodation (hotel/Airbnb): $700 – $1,400

- Food (restaurants/groceries): $500 – $1,000

- Activities (museums, tours): $300 – $600

- Transportation (trains, metro): $100 – $200

- Set a Savings Goal: Determine how much you need to save each month or week to reach your travel budget. If your estimated trip cost is $3,500 and you have six months to save, you’ll need to save approximately $583 per month.

- Track Your Spending: Monitor your expenses as you plan and book to stay within your budget. Consider using budgeting apps or spreadsheets to track expenses.

- Look for Ways to Save: Explore budget-friendly options such as off-season travel, cooking some meals instead of eating out, and taking advantage of free activities.

Budgeting for a Down Payment on a House

Buying a home is a significant financial undertaking. Saving for a down payment requires careful planning and discipline.

- Determine Your Home-Buying Budget: Consider factors like your income, debt-to-income ratio, and the current mortgage rates. A general rule of thumb is that your total housing costs (mortgage payment, property taxes, insurance) should not exceed 28% of your gross monthly income.

- Calculate the Down Payment: The down payment amount varies depending on the loan type. Conventional loans typically require a down payment of 3-20% of the home’s purchase price. FHA loans may require as little as 3.5%.

- Create a Savings Plan: Determine how much you need to save each month to reach your down payment goal. For example, if you want to buy a $300,000 house with a 10% down payment ($30,000) and have three years to save, you’ll need to save approximately $833 per month.

- Cut Expenses and Increase Income: Identify areas where you can reduce spending. Consider ways to boost your income, such as taking on a side hustle or negotiating a raise.

- Explore Savings Options: Consider high-yield savings accounts or certificates of deposit (CDs) to maximize your savings.

Budgeting for Retirement Planning

Retirement planning is crucial for securing your financial future. It’s a long-term endeavor that requires consistent saving and strategic investment.

- Estimate Your Retirement Needs: Determine how much income you’ll need to maintain your desired lifestyle in retirement. A common guideline is to aim for 70-80% of your pre-retirement income. Consider factors like healthcare costs, inflation, and your expected lifespan.

- Calculate Your Savings Goal: Based on your estimated retirement needs and your current savings, calculate how much you need to save to reach your goal. Use a retirement calculator to help with this.

- Start Saving Early: The earlier you start saving, the more time your money has to grow through compounding.

- Maximize Retirement Accounts: Take advantage of tax-advantaged retirement accounts, such as 401(k)s and IRAs. Contribute enough to your 401(k) to receive the full employer match, if offered.

- Diversify Your Investments: Invest in a diversified portfolio of stocks, bonds, and other assets to manage risk.

- Review and Adjust Regularly: Periodically review your retirement plan and make adjustments as needed based on your progress, market conditions, and changes in your life.

Sample Wedding Budget

A wedding is a joyous occasion, but it can also be expensive. Creating a detailed budget helps manage costs and prioritize spending.

| Expense Category | Estimated Cost | Notes |

|---|---|---|

| Venue and Catering | $20,000 – $50,000+ | Includes venue rental, food, drinks, and staffing. This is often the largest expense. |

| Photography and Videography | $3,000 – $10,000+ | Capturing memories for years to come. |

| Wedding Dress and Attire | $2,000 – $10,000+ | Includes the dress, suit, alterations, and accessories. |

| Flowers and Decorations | $2,000 – $8,000+ | Floral arrangements, centerpieces, and other decorations. |

| Entertainment (DJ/Band) | $1,500 – $8,000+ | Music and entertainment for the reception. |

| Cake | $500 – $2,000+ | The wedding cake and dessert table. |

| Invitations and Stationery | $500 – $2,000+ | Invitations, save-the-dates, thank you cards, and other stationery. |

| Officiant | $200 – $800+ | The person who performs the ceremony. |

| Rings | $1,000 – $10,000+ | Wedding rings. |

| Other Expenses | $1,000 – $5,000+ | Marriage license, favors, transportation, and other miscellaneous costs. |

| Total Estimated Cost | Varies Widely | The total cost will depend on your choices and priorities. |

Closure

In conclusion, “How to Create a Budget That Actually Works with a 30-Day Trial Challenge” equips you with the knowledge and tools to build a budget that fits your lifestyle. By understanding the fundamentals, setting clear goals, and embracing the 30-day challenge, you’ll be well on your way to financial freedom. Remember, budgeting is a journey, not a destination. Regular reviews, adjustments, and a commitment to good financial habits will ensure your continued success.

Embrace the challenge and start building the financial future you deserve.